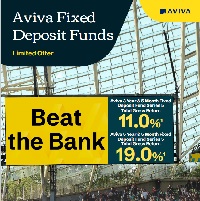

An attractive fixed return for your money

If you are looking for an attractive rate of return on your investments or pension, the Aviva Fixed Deposit Funds may be the right choice for you. There are two Funds available to new business, a 3 Year and 5 Month version and a 5 Year and 5 Month version. These Funds are available through your Financial Broker.

| Aviva 3 Year & 5 Month Fixed Deposit Series 5 | Aviva 5 Year & 5 Month Fixed Deposit Series 5 | |

|---|---|---|

| Deposit Rates | Gross Total Return of 11%1 equating to a 3.1% Gross AER | Gross Total Return of 19%1 equating to a 3.26% Gross AER |

| Maturity Dates | 04 October 2027 | 03 October 2029 |

| Closing Date | We are closing the Funds on 19 April 2024 or earlier if oversubscribed. | |

| Deposit Start Date | The deposit start date for both Series 5 Funds is 03 May 2024. | |

| Risk Rating | Rating 1 out of 7 (low risk) as of 01 March 2024 | |

| Annual Management Charge | Charge Standard Annual Management Charge2 | |

| Who can invest in these Funds? | These Funds are available through the following single contribution products open to new business2: Investment Bond Personal Pensions, PRSAs, Personal Retirement Bonds, Retail Master Trust, Pension Investment Bond* Approved Retirement Fund Top-ups are only available through certain products launched since 2020. Please contact your Financial Broker for more information. *Pension Investment Bond only offers access to the 5 Year & 5 Month Fixed Deposit Fund Series 5. | |

| Standalone or part of a portfolio | You can invest in these Funds on a standalone basis or as part of a diversified portfolio. | |

1. The gross returns and AER stated is before the deduction of charges and any applicable imputed distribution payments, life assurance premium levy, and relevant taxes. The returns are only applicable on the Fund’s maturity date.

2. The product documentation indicates product charges, minimum premiums, and applicable taxes. As these are fixed-term investments, the annual management charge will be accrued within the daily fund price and deducted from the final maturity proceeds received from Societe Generale. The final fund price will reflect the net return after deducting all fees. Our Customer Experience Team must receive full application documentation (including a fully completed application form. declaration, and anti-money laundering requirements). Otherwise, you will not be allowed to invest in these Funds.